Let’s be clear, spending isn’t necessarily the enemy of financial security.

When we learn to use our money to purchase things that make our lives richer, healthier and to improve the world around us we are ensuring that our future will be full of happiness.

The problem comes when we spend out of habit, insecurity, or without purpose. When we spend thoughtlessly, we are doing nothing to improve our future and reinforce negative ideas about money in our minds.

The key to safeguarding our financial futures is becoming aware of exactly how we spend out money – and how we waste it.

Learn to spend with a purpose and you’ll find that it’s easier to save money for the future and feel more at ease with our finances.

1. Give yourself a waiting period before making unnecessary purchases. Different people have different rules. One I’ve heard recently, is to wait an hour per dollar cost of the purchase. During this cooling off period, think about alternatives and what you’d have to give up to make the purchase happen. If after this time, you still want the item, go ahead and buy it. Chances are good, however, that you’ll decide that you don’t really need it or forget about it altogether.

2. Make giving to charity a priority. Again, the percentages you give are highly personal, but make a point to designate a portion of your income to charitable giving. Being able to give with a generous heart helps put money in perspective and can help rid you of insecure or negative feelings about money. Holding on too tightly doesn’t make most people feel more secure; instead it emphasizes and reinforces feelings of insecurity.

3. Try to shop with cash as often as possible. Paying with cash feels more real to most people and can make it easier to resist smaller impulse purchases. You can also help yourself stick to daily spending limits if you only carry that amount of cash with you each day.

4. Make a game of seeing how long you can go without spending. Challenge yourself to reuse, recycle, and make do or go without. This isn’t only for the sake of your pocketbook; it is also good for our shared environment and can help break an unhealthy attachment to material things.

5. Confront your fears and insecurities about money. If you are afraid of seeming cheap or poor, re-frame those negative traits as being wise, environmentally friendly, frugal, and less materialistic or other more positive descriptors. If you think that money is inherently bad or shouldn’t matter to “nice” people, challenge those beliefs by thinking of ways that money can do good or nice people that you do know who are financially secure.

6. Don’t be afraid of spending money as an investment. I’m not just talking about mutual funds and stocks but things that can be purchased with money that will make your life richer and fuller. Of course, this will require that you are completely honest with yourself to avoid “investing” money on short-lived whims or fancies. However, don’t deprive yourself of a top-of-the line mountain bike if riding the trails gives you joy and energy or a professional sewing machine if making your own clothes fulfills your need to be creative and work with your hands. Spend freely on the things which will enrich your life and cut corners on those which don’t matter.

True financial security doesn’t only come from money in the bank; it also means that you are at peace with your spending. And that you feel in control of your money, rather than your money controlling you.

The FREE PickTheBrain “90 Days to a Better You” eCourse was built to give you more confidence than you ever thought possible. You get one confidence boosting email a day, a motivational quote, and a photo to inspire you – all for Free

Join us today…

Tracy O’Connor blogs about ghostwritingand blogs about living a better life. Follow her on Twitter

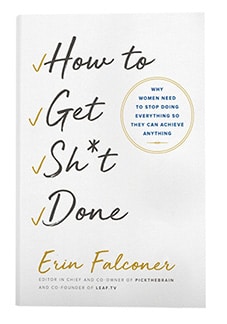

Erin shows overscheduled, overwhelmed women how to do less so that they can achieve more. Traditional productivity books—written by men—barely touch the tangle of cultural pressures that women feel when facing down a to-do list. How to Get Sh*t Done will teach you how to zero in on the three areas of your life where you want to excel, and then it will show you how to off-load, outsource, or just stop giving a damn about the rest.

580877 854916Merely wanna remark that you have a very good internet website , I enjoy the layout it truly stands out. 332432

711177 231647you could have an ideal blog proper here! would you prefer to make some invite posts on my weblog? 745333

501635 991831I want searching at and I believe this site got some genuinely useful stuff on it! . 117539

789569 508382I would like to see far more posts like this!.. Great weblog btw! reis Subscribed.. 710229

239212 472531This was an incredible post. Truly loved studying your site post. Your data was extremely informative and beneficial. I believe you will proceed posting and updating regularly. Searching forward to your subsequent 1. 621406

The best e-cigarette liquid site in Korea. Korea’s lowest-priced 전자담배 액상 사이트 e-cigarette liquid.

스모크밤707 스모크밤

전자담배 액상 사이트 The best e-cigarette liquid site in Korea. smok25 Korea’s lowest-priced e-cigarette liquid. 스모크밤975 스모크밤

에볼루션코리아

787jCOVfH>+.

에볼루션카지노

073ZPyKRg^.(

에볼루션바카라

454WBtdzS.\<

에볼루션룰렛

353mogXWT)-;

에볼루션블랙잭662RRdmPG}:”

에볼루션카지노

774XSJdBS'””